Passengers line up to board a high-speed bullet train at a railway station in Nanjing, East China’s Jiangsu Province, on April 6, 2024, the last day of the Qingming Festival holidays. About 119 million domestic tourist trips were made during the holidays. Photo: VCG

China’s consumption market during the just-ended Qingming Festival holidays showed better-than-expected performance, underscoring the strong vitality and potential of the economy while injecting new momentum in driving stable economic recovery.

During the Qingming Festival holidays, lasting from Thursday to Saturday, ticket bookings for popular domestic scenic spots surged by 5-fold compared with the same period last year, noted a report from a Chinese online travel agency Qunar sent to the Global Times on Saturday.

About 119 million domestic tourist trips were made during the holidays, up 11.5 percent from the same period in 2019, according to the Ministry of Culture and Tourism. The trips were estimated to bring in 54 billion yuan ($7.56 billion) in tourist revenue, an increase of 12.7 percent from 2019.

Many tourists kicked off the holidays with short-distance journeys. Notably, Tianshui in Northwest China’s Gansu Province and Kaifeng in Central China’s Henan Province – which have become internet sensations lately – saw the amount of hotel bookings jump by 12-fold and 4.5-fold respectively, according to Qunar.

Crowds appeared across tourist spots in China as many struggled to reach their destinations. A Beijing resident surnamed Li told the Global Times that his family has to wait for about two hours to park the car at the Juyongguan section of the Great Wall in Beijing on Thursday because there are so many tourists.

According to film ticketing platform Maoyan, the box-office revenue has reached 823 million yuan for the holidays, surpassing last year.

The service sector now contributes to around 60 percent of China’s economic growth. The robust recovery of tourism, hospitality and transport sectors will boost the overall recovery of domestic consumption and contribute to stable economic recovery, Xu Xiaolei, a marketing manager at China’s CYTS Tours Holding Co, told the Global Times on Saturday.

The potential of the consumption market is set to be further unleashed during the upcoming May Day holidays, Xu said, noting the surge of China’s consumption market reflects the strong vitality and potential of the economy.

Stable recovery

In addition to the robust recovery in the cultural and tourism sectors, the country’s manufacturing purchasing managers’ index (PMI) posted better-than-expected result in March, indicating notable increase in internal demand.

Analysts said that the world’s second-largest economy got off to a good start in the first quarter of 2024, laying a solid foundation for achieving the pre-set annual GDP growth target of around 5 percent.

“Between January and March, China’s economic growth rate is expected to reach around 5 percent on a yearly basis, supported by a couple of factors including consumers’ increased willingness to spend, stable infrastructure and manufacturing investment as well as improved external environment,” Wen Bin, chief economist from China Minsheng Bank, told the Global Times on Saturday.

There are multiple aspects where Chinese authorities can step up efforts in the second quarter to bolster the upswing recovery of the economy, according to Wen.

This year’s Government Work Report outlined an array of measures to boost growth this year. According to the report, a proactive fiscal policy and a prudent monetary policy will be continued in 2024, and a series of tasks will be taken to modernize the industrial system and develop new quality productive forces at a faster pace.

Wen said the central bank is expected to strengthen efforts to enhance “precision and effectiveness” of monetary policies so as to inject new momentum to the high-quality development of the economy. On the one hand, efforts should be made to boost economic structure adjustment, economic transformation and upgrade and the transition of old and new momentums, while on the other hand, the authorities should better meet reasonable consumption and fund-raising needs with targeted measures, he said.

Cao Heping, an economist at Peking University, said he is optimistic about the country’s GDP growth rate in the first quarter. “The development of new quality productive forces has triggered the new driver of China’s development,” Cao told the Global Times, noting the country will remain the main driver of world economic growth in 2024.

Positive prospect

Driven by China’s stable economic recovery so far this year, foreign-funded companies have voted with their feet to briskly expand investment in China for unprecedented opportunities amid the country’s high-level opening up.

In January, US retail giant Costco Wholesale opened a new store in Shenzhen, Guangdong Province, which is the sixth Costco store on the Chinese mainland. The number of registered members surpassed 140,000 on the first day alone, setting a record globally, according to local media outlet Shenzhen Daily.

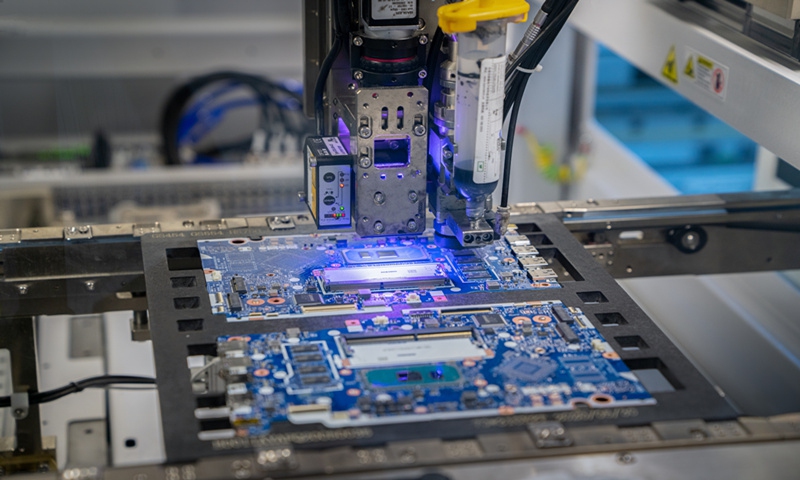

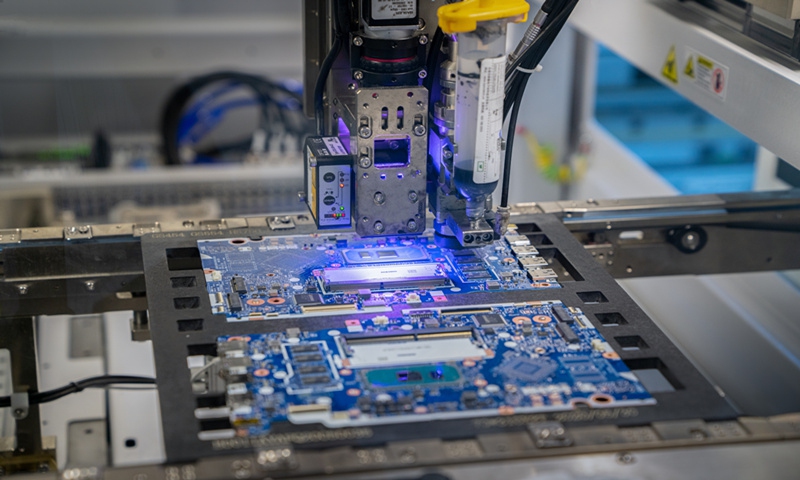

On March 21, US smartphone maker Apple inaugurated its largest retail store on the Chinese mainland in Shanghai, with Apple CEO Tim Cook opening the doors of the new store and welcoming Chinese consumers.

During a meeting with Chinese Commerce Minister Wang Wentao on March 22, Cook said China is an important market with a rich talent pool and innovation vitality, and a crucial supply chain partner for Apple. He reaffirmed that Apple is committed to a long-term development in China and plans to increase investment in China’s supply chain, research and development, and marketing.

In order to steadily promote high-level opening-up and make greater efforts to attract and utilize foreign investment, the General Office of the State Council issued an action plan on March 19. The action plan proposes 24 measures across five aspects, including expanding market access, enhancing appeal to foreign investment and fostering a level playing field.

The Chinese government is cultivating new quality productive forces, signifying the country is on the correct development trajectory, John Ross, a senior fellow at the Chongyang Institute for Financial Studies, told the Global Times in a recent interview in Beijing.

Based on observations and research over the past 30 years related to China’s economy, there is no reason why China cannot meet its 2024 GDP growth target, and undoubtedly, the country will remain the main driver of world economic growth as it has for the past 40 years, he said.