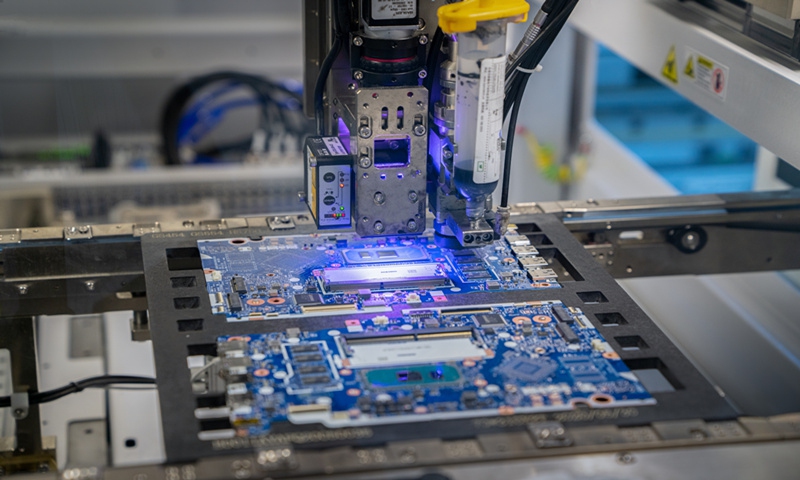

A chip manufacture machine Photo: VCG

Japan should be wary in its semiconductor cooperation with the US, which is seeking hegemony, Chinese observers said on Wednesday. If it tries to hit China at the bidding of the US, Japan’s industries risk being victimized, analysts noted.

The remarks came as Japanese Prime Minister Fumio Kishida said on Tuesday (US time) that he saw opportunities for more collaboration with the US in next-generation computer chips. Kishida and US President Joe Biden are scheduled to meet on Wednesday.

Major agreements expected to come out of the meeting include a $2.9 billion deal by US tech giant Microsoft to expand its cloud and artificial intelligence infrastructure in Japan, and a partnership between Japanese chip foundry venture Rapidus with a US company in the research and development of next-generation chips, according to Reuters.

Although not mentioning China directly, Kishida said on Tuesday that “it is increasingly important for our two countries to build resilience in our economies and together drive growth for the global economy.”

Japan’s pledge for closer semiconductor cooperation with the US was coupled with its push to produce chips domestically and Washington’s escalating crackdown and containment strategy against China in the field of semiconductors by pushing its allies.

In a recent move, the US is reportedly pushing Netherlands-based chipmaking giant ASML to stop servicing some equipment it has sold to Chinese customers, in blatant violation of business contracts.

However, Chinese observers said Japan needs to be careful in its chip cooperation with the US or risk facing consequences.

Ma Jihua, a veteran telecom observer, told the Global Times on Wednesday that the US has been trying to woo its allies including South Korea and Japan to join its crackdown on the Chinese semiconductor sector.

South Korean chip companies have become victims of the US containment of China, seeing a sharp drop in the export value of semiconductor tooling machines while Japanese and Dutch exports to China rose in 2023, according to South Korean newspaper Dong-a Ilbo.

Chinese analysts said that any cooperation between Japan and the US should not target any third party, and efforts in strengthening high-tech industry supply chain resilience should not become a disguise for technology containment against China.

Da Zhigang, director of the Institute of Northeast Asian Studies at Heilongjiang Provincial Academy of Social Sciences, told the Global Times on Wednesday that it seems apparent that Japan’s partnership with the US in the high-tech field has a target in mind, which is regrettable.

Da said that if detailed curbs or export technology bans emerge from its partnership with the US, Japan will face mounting risks in its trade with China, which totaled $317.99 billion in 2023 per customs data.

“For Japan, its interests lie in enhancing mutually beneficial trade and economic ties with its Asian neighbors, rather than colluding with external forces to crack down on its major trading partner,” Da said.

Japanese semiconductor companies at the upstream of the industrial chain may suffer if the Japanese government chooses to work with the US to disrupt global semiconductor industrial and supply chains, noted Da.

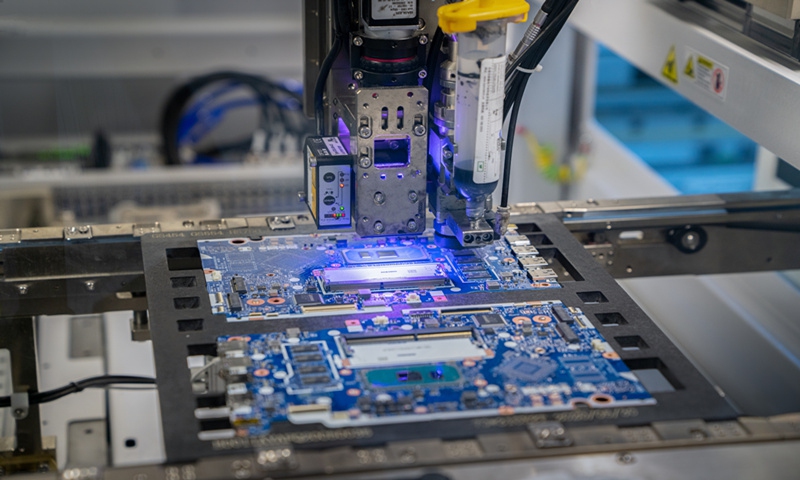

A staff member works on the production line of a semiconductor production company in Yangxin county, Binzhou city, East China’s Shandong province on April 1, 2024. [Photo/VCG]

A staff member works on the production line of a semiconductor production company in Yangxin county, Binzhou city, East China’s Shandong province on April 1, 2024. [Photo/VCG]