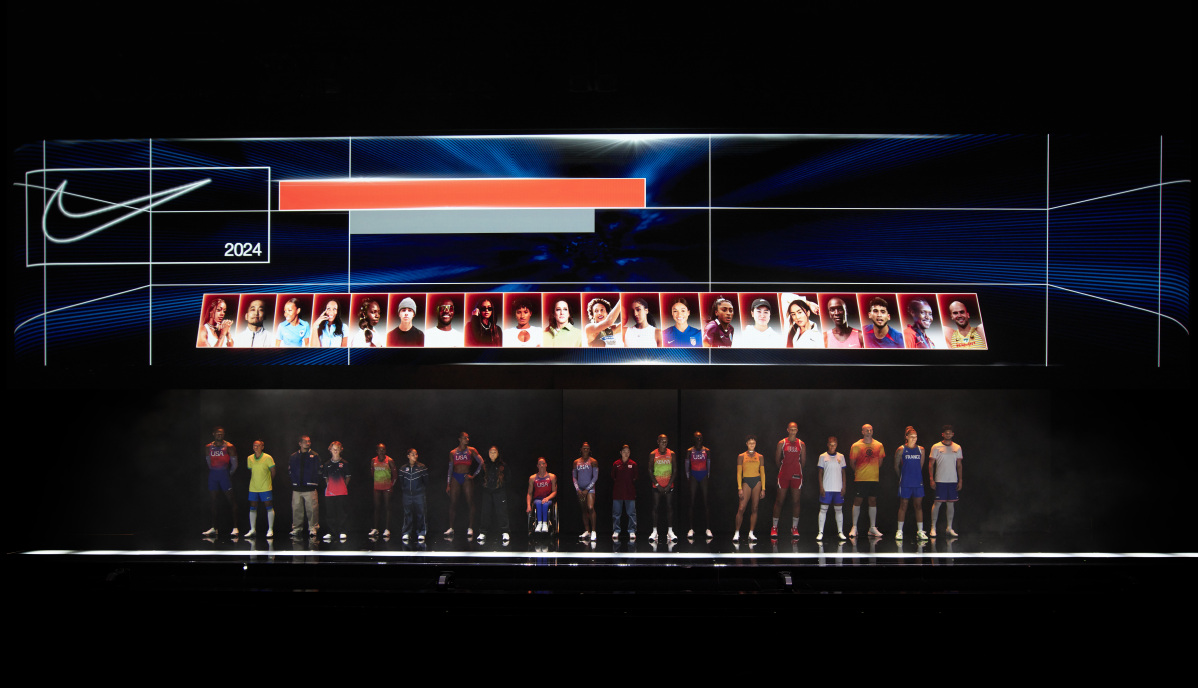

Nike showcases its latest pipeline of innovations, together with 40 world-class elite athletes, during an event in Paris in April. [PHOTO/CHINA DAILY]

Nike showcases its latest pipeline of innovations, together with 40 world-class elite athletes, during an event in Paris in April. [PHOTO/CHINA DAILY]

Global sportswear brand Nike is doubling down on the Chinese market by leveraging a responsive and localized creative platform as well as innovations centered on its patented Air technology.

The initiative — to drive growth — aims to bring in freshness, solidify its dominant position in the sportswear industry, and enhance its connections with younger consumers globally.

John Donahoe, president and CEO of Nike Inc, said the sportswear brand will continue to invest steadily in China.

“China is a very important market for Nike. It always has been and always will be. We’re committed to investing in China. We believe in China. We’ll keep doubling down on our proven playbook for success in driving innovative products in China,” he said.

Nike Inc posted a 6 percent year-on-year growth in sales in China to $2.08 billion in the third quarter of fiscal year 2024, the sixth consecutive quarterly increase here for the sportswear company.

This was powered by its Dragon Year collection during the Spring Festival holiday and innovations in running, basketball, women and kids categories.

The company has leveraged its global innovation platform to drive novelty in China.

“You will see us increasingly bringing exciting innovations all over the world based on Air technology,” said Donahoe. “We can hyper-localize them for markets in China and other markets.”

For example, the global launch of Air Max DN shoes is expected to have a China-specific version, featuring local colorways, collaborations, campaigns and engagements with athletes, he said.

Nike has invested more than 2 billion yuan ($276 million) in its technology center in Shenzhen, Guangdong province, and an automated storage and retrieval system in its China logistics center in recent years.

Nike is also investing in local innovation capabilities, as demonstrated by the establishment of its Nike Sport Research Lab this year.

The lab works with Chinese athletes and consumers to gain insight and develop innovations driven by, and unique to, the Chinese market.

The company is also investing in hyper-localizing its storytelling and brand through Icon Shanghai, which plans to be a creative studio program aimed at translating global messaging into locally resonant content, responding rapidly to the dynamic Chinese market.

Donahoe said it is crucial to stay close to consumers, particularly in China, where consumer preferences evolve quickly.

“We’re doing things to accelerate how quickly we can respond to the consumer. China’s really the market where we’re doing that the most. We’re leaning in, trying new ways to pull forward innovations and get them in the market.”

“We are going to speed up the innovation cycle for each season and each product based on the market feedback,” he said. “We want Nike to be a global brand for Chinese consumers and it’s of China.”

The CEO emphasized the dynamic nature of the Chinese market, describing it as “innovative and progressive, in style and the digital world”.

“We’ll continue to innovate in China, enhancing both online and retail experiences across over 6,000 retail stores,” he said.

“We believe that Chinese consumers are ahead of the rest of the world in many ways. We take learning from China to the rest of the world.”

Donahoe said both the Nike brand and the Jordan brand have several potential opportunities in China.

The company opened its World of Flight, a top-end retail concept of the Jordan brand, in Beijing last month. Nike has run mono-brand stores such as the Nike Rise, Nike Style, and the House of Innovation, its flagship store in Shanghai.

Digitally, the company operates its own applications, as well as stores on e-commerce platform Tmall and short-video sharing platform Douyin.

“What’s interesting is you don’t have a digital or physical consumer. Sometimes you shop online. Sometimes you go into store. We need to be there with both,” Donahoe said. “Nike is a premium brand and we’ll try to drive and deliver a premium experience in China.”

Innovation on Air

Competition in the sportswear sector in China has intensified, with new players capturing significant market share in their respective categories.

Kemo Zhou, consultant researcher at Euromonitor International, said in 2023 the overall sportswear market in China remained under the dominance of leading sportswear groups. However, intensifying competition from fast-growing brands has been a significant impetus for the growth of the overall sportswear category.

Zhou cited outdoor brands such as The North Face, Camel and Salomon emerging as major contenders.

Meanwhile, Lululemon has maintained its remarkable growth trajectory, Zhou added.

“Initially associated with yoga apparel, the brand has witnessed a surge in popularity transcending its core market segment. Consumers increasingly integrate Lululemon’s products into their everyday wear,” he said.

Zhou said the increased consumer interest in equipment-free exercise, particularly running and hiking, has fostered demand for sports footwear brands specializing in specific activities, such as niche running shoe brands Hoka and On.

Beijing’s first private enterprise technology innovation center was unveiled on Tuesday in Fengtai district. [Photo provided to chinadaily.com.cn]

Beijing’s first private enterprise technology innovation center was unveiled on Tuesday in Fengtai district. [Photo provided to chinadaily.com.cn]

A view of the booth of Huawei at the 2024 Mobile World Congress Barcelona in Spain earlier this year. GAO JING/XINHUA

A view of the booth of Huawei at the 2024 Mobile World Congress Barcelona in Spain earlier this year. GAO JING/XINHUA