Editor’s note: Zhu Fangfei is the director at the Research Department of the Institute for Public Policy of Zhejiang University. The article reflects the author’s opinions and not necessarily the views of CGTN. It has been translated from Chinese and edited for brevity and clarity.

China has issued the first batch of special treasury bonds with terms exceeding 30 years showing evident “ultra-long-term” characteristics. Previously, China issued special treasury bonds in 1998, 2007 and 2020, contributing to economic and social stability and development. Compared to previous issuances of special treasury bonds, the proposed ultra-long-term special treasury bonds this time stand out in three aspects:

First, they have ultra-long terms. Long-term bonds are typically those with terms of 10 years or more. Special treasury bonds issued this time have terms of at least 10 years, with some reaching 30 and even 50 years. Historically, China has rarely issued treasury bonds with terms of 30 years or more, and the total outstanding balance of treasury bonds with remaining terms exceeding 25 years is less than 2 trillion yuan ($277 billion). The special treasury bonds for COVID-19 pandemic control issued in 2020 and the additional treasury bonds issued in the fourth quarter of 2023 mostly had maturities of 10 years or less.

An image depicting the Chinese phrase for ultra-long-term treasury bonds. /CFP

An image depicting the Chinese phrase for ultra-long-term treasury bonds. /CFP

An image depicting the Chinese phrase for ultra-long-term treasury bonds. /CFP

Second, they have specific purposes. According to information from the country’s government work report, ultra-long-term special treasury bonds are issued to systematically address funding issues for major projects in the process of building a strong nation and achieving national rejuvenation. Relevant funds will be specifically allocated to support the implementation of major national strategies and build up security capacity in key areas. The bonds will be used to support work in multiple fields, including science and technology innovation, integrated urban-rural development, coordinated regional development, food and energy security and high-quality population growth, Zheng Shanjie, chairman of the National Development and Reform Commission, said in March this year.

Third, they are under special management. Unlike ordinary long-term construction treasury bonds, these ultra-long-term special treasury bonds are included in the government fund budget and are not counted towards the country’s deficit. This means they should be used for specific purposes and not for general expenditures. Meanwhile, the principal and interest payments shall come from special revenues.

Given the above characteristics, these ultra-long-term special treasury bonds planned to be issued this time will not only help boost current domestic demand and stabilize the macroeconomy but also lay a solid foundation for high-quality development.

Consumers purchasing home appliances in Shanghai, China, May 12, 2024. /CFP

Consumers purchasing home appliances in Shanghai, China, May 12, 2024. /CFP

Consumers purchasing home appliances in Shanghai, China, May 12, 2024. /CFP

Firstly, these bonds will optimize the current structure of China’s government debt and enhance fiscal sustainability. On one end, medium and long-term debt represents a relatively small proportion of China’s current government debt. Special treasury bonds issued this time are ultra-long-term, meaning that the government will only need to pay interest over a long period, and the principal is repaid much later. This relieves debt repayment pressure and enhances fiscal sustainability.

On the other end, central government debt accounts for 42.4 percent of China’s government debt, which is lower compared to most countries. The central government will repay the principal and pay the interest for the 1-trillion-yuan special treasury bonds proposed for issuance this year. Relying on the credit of the central government, the interest rate of these bonds is lower than that of local government bonds of the same term, thus helping reduce the overall government borrowing costs.

Secondly, these bonds will stimulate current investment and consumption, thereby boosting domestic demand. On one end, issuing ultra-long-term special treasury bonds sends a positive signal to the market about the government’s proactive fiscal policy and stabilizes market expectations. On the other end, the 1 trillion yuan in special treasury bonds serves as a significant force in driving domestic demand. From a fiscal expenditure perspective, the ratio of China’s total fiscal expenditure to GDP is about 30 percent. Strengthening fiscal expenditure intensity by issuing these 1-trillion-yuan special treasury bonds this year will further stimulate domestic demand.

From the viewpoint of expanding effective investment, China’s fixed-asset investment grew at a rate of 2.8 percent in 2023, with infrastructure investment growth at 5.9 percent and social sector investment (mainly in education, health and culture) at 0.5 percent. The proposed special treasury bonds will be used for investment in implementing major national strategies and building up security capacity in key areas, thus stimulating further recovery of investment growth this year.

People shopping in an outdoor mall in Beijing, China, May 3, 2024. /CFP

People shopping in an outdoor mall in Beijing, China, May 3, 2024. /CFP

People shopping in an outdoor mall in Beijing, China, May 3, 2024. /CFP

Thirdly, these bonds hold paramount significance for promoting high-quality development. The special treasury bonds issued this time will be dedicated to implementing major national strategies and building up security capacity in key areas, including technology innovation, integrated urban-rural development, coordinated regional development, food and energy security and high-quality population growth. These fields are crucial for implementing new development concepts and supporting innovative, green, coordinated, open and shared development.

However, these bonds also face issues such as enormous potential construction demands, extended investment cycles, low market return, and insufficient funding channels. The special government bonds issued this time will help address these challenges, enabling government investment to play a key role in optimizing the supply structure and driving economic structural transformation and upgrade by raising quality and efficiency through fiscal policies.

(Cover via CFP)

A man displays a newspaper article detailing the attack on Slovak Prime Minister Robert Fico outside the F. D. Roosevelt University Hospital in Banska Bystrica, Slovakia, May 16, 2024. /CFP

A man displays a newspaper article detailing the attack on Slovak Prime Minister Robert Fico outside the F. D. Roosevelt University Hospital in Banska Bystrica, Slovakia, May 16, 2024. /CFP

A view of China National Petroleum Corporation (CNPC) Fushun Petrochemical Company, Fushun City, Liaoning Province, northeast China. /CGTN

A view of China National Petroleum Corporation (CNPC) Fushun Petrochemical Company, Fushun City, Liaoning Province, northeast China. /CGTN  Lu Chuantao, the deputy manager of Refinery No. 3 in CNPC Fushun Petrochemical Company talks to CGTN reporter, Fushun City, northeastern China’s Liaoning Province. /CGTN

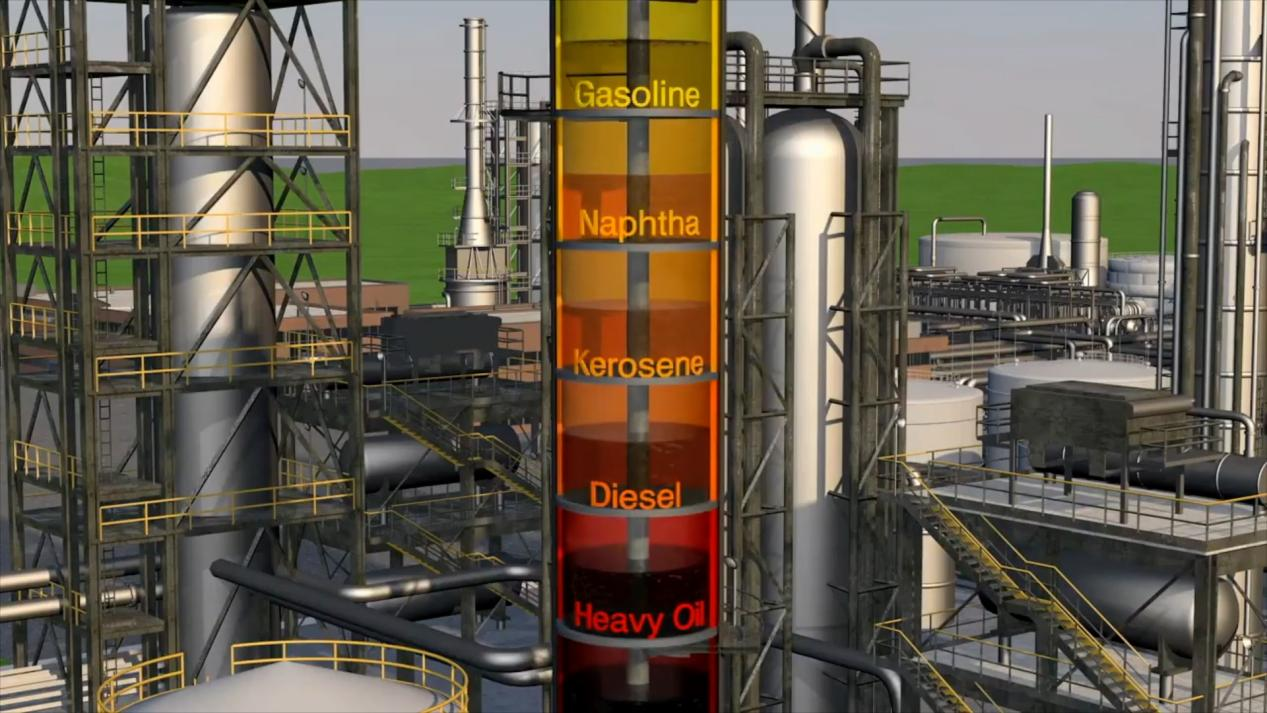

Lu Chuantao, the deputy manager of Refinery No. 3 in CNPC Fushun Petrochemical Company talks to CGTN reporter, Fushun City, northeastern China’s Liaoning Province. /CGTN  An illustration shows how the refineries convert crude oil into petroleum products for use as fuels for transportation, heating, paving roads, and as feedstock for making chemicals. /CGTN

An illustration shows how the refineries convert crude oil into petroleum products for use as fuels for transportation, heating, paving roads, and as feedstock for making chemicals. /CGTN  Staff on duty at CNPC Fushun Petrochemical Company in Fushun City, northeastern China’s Liaoning Province. /CGTN

Staff on duty at CNPC Fushun Petrochemical Company in Fushun City, northeastern China’s Liaoning Province. /CGTN  A view of the world’s largest hydrocracker reactor developed by China First Heavy Industries Group. /CGTN

A view of the world’s largest hydrocracker reactor developed by China First Heavy Industries Group. /CGTN  The hydrocracker upgrades low-quality heavy gas oils into high-quality, clean-burning jet fuel, diesel and gasoline. /CGTN

The hydrocracker upgrades low-quality heavy gas oils into high-quality, clean-burning jet fuel, diesel and gasoline. /CGTN  The new reactor is capable of treating large amounts of distillate to obtain kerosene, naphtha and gasoline, hence increasing the efficiency for refinery operations. /CGTN

The new reactor is capable of treating large amounts of distillate to obtain kerosene, naphtha and gasoline, hence increasing the efficiency for refinery operations. /CGTN  Welding engineer Zhu Lin from China First Heavy Industries Group (Dalian), northeast China’s Liaoning Province. /CGTN

Welding engineer Zhu Lin from China First Heavy Industries Group (Dalian), northeast China’s Liaoning Province. /CGTN  Worker from China First Heavy Industries Group (Dalian), northeast China’s Liaoning Province. /CGTN

Worker from China First Heavy Industries Group (Dalian), northeast China’s Liaoning Province. /CGTN  Zhang Lin, the deputy chief engineer from China First Heavy Industries Group (Dalian), talks with CGTN reporter, Dalian City, northeast China’s Liaoning Province. /CGTN

Zhang Lin, the deputy chief engineer from China First Heavy Industries Group (Dalian), talks with CGTN reporter, Dalian City, northeast China’s Liaoning Province. /CGTN  Workers on duty at hydrocracking reactor production line of China First Heavy Industries Group (Dalian), northeast China’s Liaoning Province. /CGTN

Workers on duty at hydrocracking reactor production line of China First Heavy Industries Group (Dalian), northeast China’s Liaoning Province. /CGTN